Introduction To Frauds

Fraud Definition: An organization loses typical 5% of revenue due to fraud each year. As per Oxford dictionary, fraud is defined as wrongful or criminal deception intended to result in financial or personal gain. The most common characteristics of frauds are being uncommon, impeccably concealed, time evolving and carefully organized. Fraud cases are covered by lots of non-fraudulent cases, only minority are fraud cases; hence fraud is uncommon. It makes harder to detect frauds. Fraudster try to blend in and not behave different from normal behavior, it makes fraud impeccably concealed. Fraudsters change their way of doing fraud with time in order not to get caught, hence its time evolving. Fraudsters often operate in group to avoid getting caught, and hence they plan carefully, its organized crime.

Different types of Fraud: There are various kinds of frauds such as credit card fraud, insurance fraud, health care fraud, money laundry, identity fraud, and tax fraud. In credit card fraud, there are application fraud and behavioral fraud in credit card. In application fraud, it involves getting new credit by using false details. In behavioral fraud, credit card is often used by someone else without owner’s knowledge. In insurance fraud, its application and claim frauds. In application fraud, someone is insured using either false personal details or often hiding the condition of insured. In claim fraud, claim is being made using false means. Healthcare fraud often involves making false claim by collusion of doctor and patient. Money laundry and tax invasion is often being confused. Money laundry is often converting illegal money into legal by using wrong means. Tax invasion is not paying the due taxes on income. Identity fraud is making use of other identity for wrongful activities.

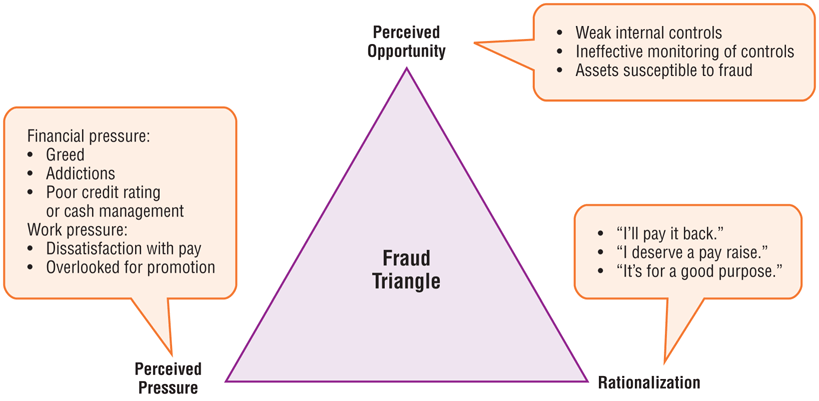

Motivation behind the fraud: Motivation behind fraud can be explained by fraud triangle. Three possible reason for a someone to do frauds are shown in below diagram (Image source- Internet).

Pressure: it is first component of fraud triangle, there could be financial and work pressure in the current situation. It’s not possible to resolve it by authorized means.

Opportunity: its second component of fraud triangle and fraudster see the fraud opportunity to deal with current situation. Internal controls are weak.

Rationalization: its psychological mechanism by which fraudsters try to justify the fraud, they commit. They think that its acceptable behavior in current situation.

Estimated losses due to Frauds: Fraudster achieve personal gains, which comes at the cost of other honest member of society. To compensate again the loss due to fraud, insurance company will increase the cost of premium. Below is cost of different frauds as per different organizations:

- As per ACFE( acfe.com), an organization loses 5% of revenues due to fraud

- As per FBI( fbi.gov), total cost of insurance fraud is estimated to be $40 Billion per year in USA

- As per national fraud authority, cost of frauds in UK is estimated to be £73 Billion a year

- Credit card company lose 7% of their revenue due to fraud (source internet)

Fraud detection and prevention systems: The above losses highlight the need of a sound fraud detection and prevention system. Fraud detection refers the ability to detect the various kinds of frauds, while prevention refers the measure, which we can take in order to stop the fraud happening. Both techniques complement each other. Classical approach to fraud detection is making rule based out of experience of experts, these rules are implemented in transaction and claim system in order to check for fraud when a transaction takes place. These rules create red flag for frauds, for example:

- Amount of claim is exceeding the estimated value of property

- There are no police reports available for a car accident

- There is no witness to fire to a house

If any of such flag comes then investigation officer is alerted for fraud investigation. Its possible to build such simple system but expansive to build because

- Rule needs to be updated frequently, since fraudster keeps the system on toes by changing their strategies

- Investigation officers needs to spend more time on investigation

- The rules are built on experience, hence its not possible to detect new ways of doing frauds

- Lots of manual work required in the process, hence it takes time to process the claim

Hence an alternative but complementary approach is needed to address the above issues. That’s where we come on using the machine learning techniques. The advantage of using machine learning techniques is

- It’s possible to detect past frauds using the behavioural score card

- It’s possible to detect new frauds using outlier detection techniques

- It’s possible to flag potential fraudster using the fraud ring, since fraudster work in group rather than alone

- Less manual work is required since it’s possible to flag the potential fraudster, possible variable of fraud, how the fraud happened, where the fraud happened, the possible motivation of fraud

- The process is faster since fraud data scientist gives insight of most of the above issues and, claim and transactions can be processes faster.

Source: Lots of information is used from various research papers and internets. I would like to give due credits to them.